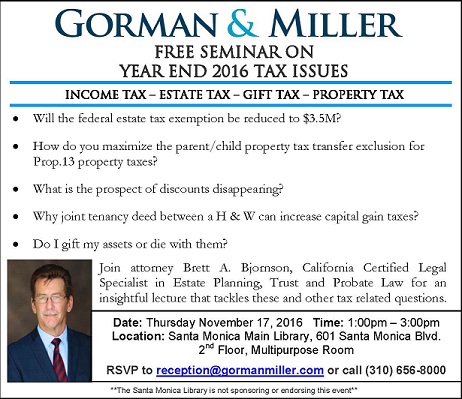

FREE ESTATE TAX PLANNING SEMINAR

Free Seminar on 2016 Year End Tax Issues; including Income Tax, Estate Tax, Gift Tax, and Property Tax. The seminar will address some of the most common tax planning considerations such as:

- Will the federal estate tax exemption be reduced to $3.5M?

- How do you maximize the parent/child property tax transfer exclusion for Prop.13 property taxes?

- What is the prospect of discounts disappearing?

- Why joint tenancy deed between a H & W can increase capital gain taxes?

- Do I gift my assets or die with them?

Date and Time

Thursday Nov 17, 2016

1:00 PM - 3:00 PM PST

Date: Thursday November 17, 2016

Time: 1:00pm – 3:00pm

Location

Santa Monica Main Library

601 Santa Monica Blvd., 2nd Floor, Multipurpose Room

Santa Monica, CA 90401

Fees/Admission

FREE

Contact Information

reception@gormanmiller.com

Send Email